"Modelo de Agregación Global de Riesgos para Instituciones Bancarias "

DOI:

https://doi.org/10.21919/remef.v6i1.15Abstract

This paper poses a methodology to estimate the total economic capital for a banking institution by using a diversified risk capital measure by business line and type of risk. The proposed model can be characterized as a hybrid approach which includes components for market, credit and operational risk. The central ingredients of the approach rely on the use of dependence structures (copulas) to capture the interactions between risk factors in a multivariate context, the modeling and time series aggregation for different frequencies, and the ability to incorporate joint effects on the portfolio losses and the considered risks. The approach is structured on four main stages: 1) the daily returns of market risk factors are described through time series models whose innovations are Students t-distributed; 2) credit risk parameters are correlated with market variables on annual basis through elliptical copulas from Student’s t-family; 3) the loss distributions for the considered risk types are determined by non-linear functions of the risk factors; and 4) on a yearly basis, operational losses are simulated conditional to market and credit losses.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

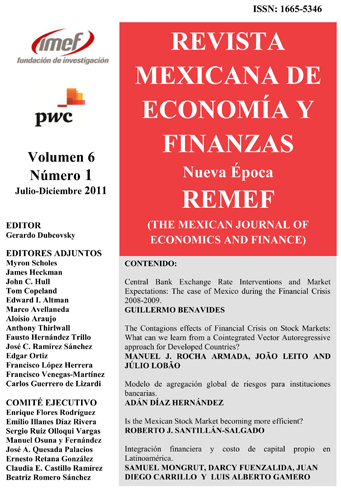

How to Cite

Díaz Hernández, A. (2017). "Modelo de Agregación Global de Riesgos para Instituciones Bancarias ". The Mexican Journal of Economics and Finance, 6(1). https://doi.org/10.21919/remef.v6i1.15

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas