"The Contagion Effects of Financial Crisis on Stock Markets: What Can We Learn From a Cointegrated Vector Autoregressive Approach for Developed Countries? "

DOI:

https://doi.org/10.21919/remef.v6i1.14Abstract

This research applies a set of diversified tests that have not been used on a joint basis to study the contagion effects of financial crises in the stock markets of developed countries. This is particularly important due to the fact that the existing literature has, so far, failed to adequately address the effects of financial crisis on such markets. Several empirical tests are performed on a joint basis: correlation tests; Kolmogorov-Smirnov tests; extreme value tests; and tests based on the estimation of Cointegrated Vector Autoregressive models. Significant evidence on the existence of contagion effects is provided with regards to the Asia crisis, the Russia crisis and the September 11 crisis. Finally, limited evidence is detected regarding the contagion effects on Brazil, Argentina and Mexico crisis.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

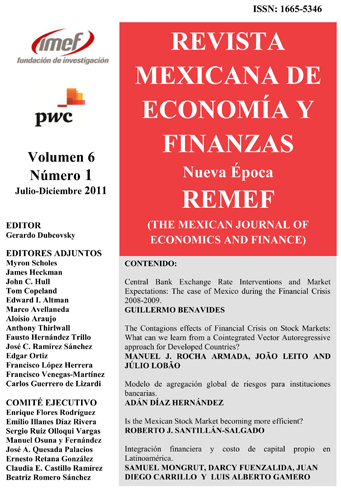

How to Cite

Rocha Armada, M. J., Leitão, J., & Lobão, J. (2017). "The Contagion Effects of Financial Crisis on Stock Markets: What Can We Learn From a Cointegrated Vector Autoregressive Approach for Developed Countries? ". The Mexican Journal of Economics and Finance, 6(1). https://doi.org/10.21919/remef.v6i1.14

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas