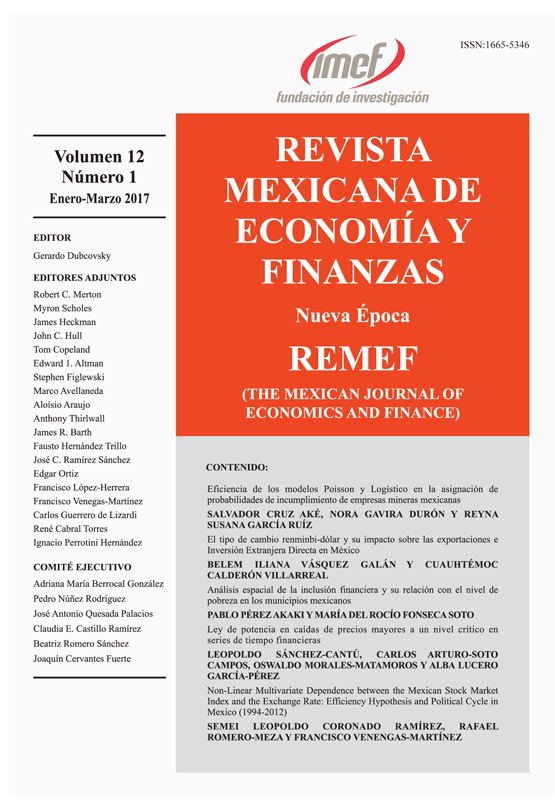

The renminbi exchange rate and its impact on Mexico´s exports and Foreign Direct Investment

DOI:

https://doi.org/10.21919/remef.v12i1.10Abstract

This is an analysis of the effect of a fluctuation of the renminbi-dollar exchange rate on Mexican exports directed to the US market and on foreign direct investment coming from the United States. Estimates of an error correction vector with data from 1995 to 2015 indicate that a depreciation of the renminbi reduces the growth of Mexican exports by 2.01 percent but has no effect on FDI. Implying that by being close competitors with China, the Mexican export sector is vulnerable to Chinese monetary policy which favors the depreciation of its currency and, with that, contributes to the displacement of Mexican exports. The results of our article offer empirical evidence to be able to understand why Mexico has lost its share in the US market while China has gained even more. Compared with other studies, our results, with a more ample period, allow us to conclude that the diversification of exports increases the sensitivity to a depreciation of the renminbi thus, it is advisable to promote the export of goods with less elasticity.Downloads

Download data is not yet available.

Metrics

Metrics Loading ...

Downloads

Published

2017-05-23

How to Cite

Vásquez Galán, B. I., & Calderón Villarreal, C. (2017). The renminbi exchange rate and its impact on Mexico´s exports and Foreign Direct Investment. The Mexican Journal of Economics and Finance, 12(1). https://doi.org/10.21919/remef.v12i1.10

Issue

Section

Research and Review Articles

License

PlumX detalle de metricas