VOLATILIDAD ESTOCÁSTICA, TEORÍA DE VALORES EXTREMOS Y VALUACIÓN DE DERIVADOS: CALIBRACIÓN Y ANÁLISIS DE 3 MODELOS DE PROCESOS ESTOCÁSTICOS PARA EL ÍNDICE DE LA BMV DE 1990 a 2005

DOI:

https://doi.org/10.21919/remef.v5i1.217Abstract

In this paper three models of stochastic processes are tested both in terms of econometric fit and of their predictive power for the prices for derivatives traded in the Mexican derivatives market (MexDer). The asset studied is the Mexican Stock Exchange Index. The model proposed in the paper includes Poisson jumps, truncated Fréchet distributions and coherent measures of risk, as well as stochastic volatility. This model shows the best econometric fit and also the best predictive power, specially in 2006, when Puts are much more expensive than Black Scholes or a stochastic volatility CIR model predict. This paper has very important implications for compensation chambers and in the risk management of portfolios similar in structure to the index of the Mexican stock market.Downloads

How to Cite

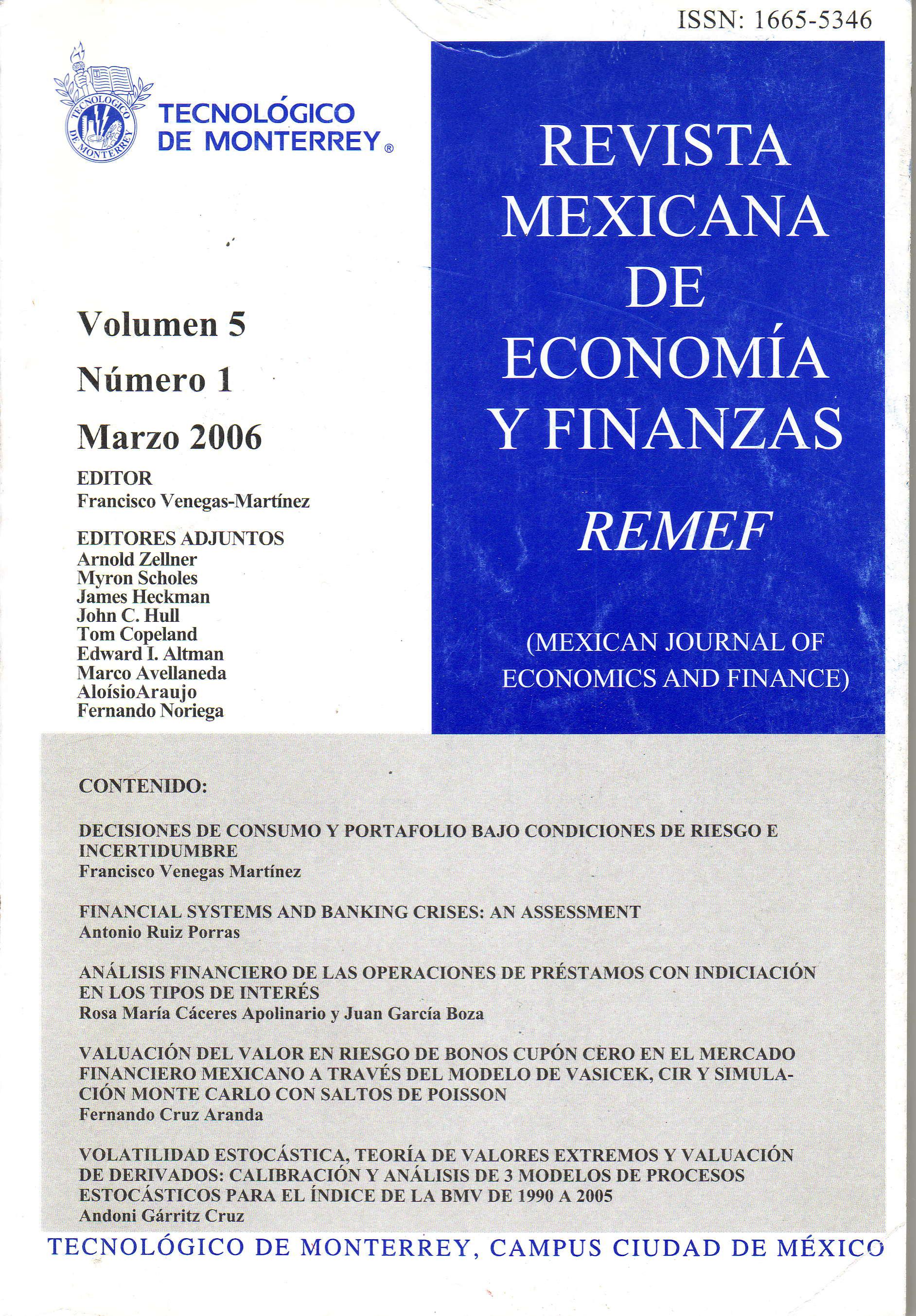

Gárritz Cruz, A. (2017). VOLATILIDAD ESTOCÁSTICA, TEORÍA DE VALORES EXTREMOS Y VALUACIÓN DE DERIVADOS: CALIBRACIÓN Y ANÁLISIS DE 3 MODELOS DE PROCESOS ESTOCÁSTICOS PARA EL ÍNDICE DE LA BMV DE 1990 a 2005. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 5(1). https://doi.org/10.21919/remef.v5i1.217

Issue

Section

Artículos