VALUACIÓN DEL VALOR EN RIESGO DE BONOS CUPÓN CERO EN EL MERCADO FINANCIERO MEXICANO A TRAVÉS DEL MODELO DE VASICEK, CIR Y SIMULACIÓN MONTE CARLO CON SALTOS DE POISSON

DOI:

https://doi.org/10.21919/remef.v5i1.216Abstract

In this paper, the "Value in Risk" of a bond coupon zero is calculed. Daily rate of return of CETES-28 days in the period from 3 May 2004 to 8 March 2006 is used. short rate is guided by a stochastic differential equation in the Vasicek model and Cox-Ingersoll-Ross model (cIR). The estimation of the parameters is by oLS and GMM respectively. Also, it is determined the structure of terms of the bond coupon zero. Finally the bond coupon zero price is calculated by Monte Carlo simulation, the dynamic of short rate follows a stochastic process such as Vasicek and CIR and Poisson jumps are gotten up, it lead us to a series of conclusions and recommendations.Downloads

How to Cite

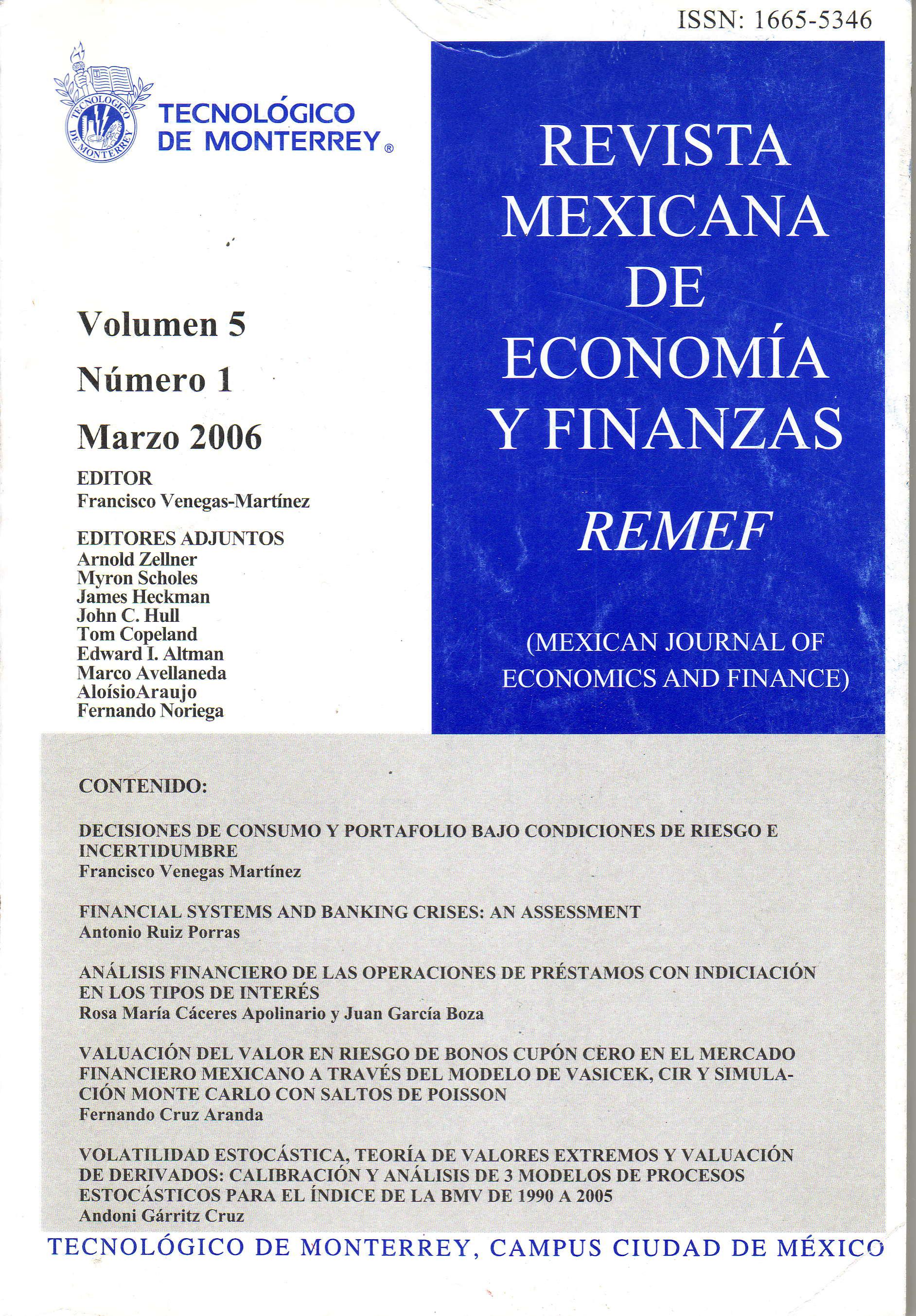

Cruz Aranda, F. (2017). VALUACIÓN DEL VALOR EN RIESGO DE BONOS CUPÓN CERO EN EL MERCADO FINANCIERO MEXICANO A TRAVÉS DEL MODELO DE VASICEK, CIR Y SIMULACIÓN MONTE CARLO CON SALTOS DE POISSON. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 5(1). https://doi.org/10.21919/remef.v5i1.216

Issue

Section

Artículos