FINANCIAL SYSTEMS AND BANKING CRISES: AN ASSESSMENT

DOI:

https://doi.org/10.21919/remef.v5i1.214Abstract

Traditionally an old concern among economists has referred to the effects that specific financial systems may have on economic performance. Here we investigate the "stylised facts" among financial systems and banking crises by using individual and principal-components indicators and sets of OLS regressions. The study relies on a set of banking fragility, financial structure and development indicators for a sample of 47 economies between 1990 and 1997. The stylised facts suggest that financial development is associated to financial systems leaded by stock and securities markets. Furthermore the evidence suggests that such association is magnified during episodes of borderline or systemic banking crises. Thus what our findings might suggest is that banking crises may encourage financial development and the transformation of financial systems into market-based ones.Downloads

How to Cite

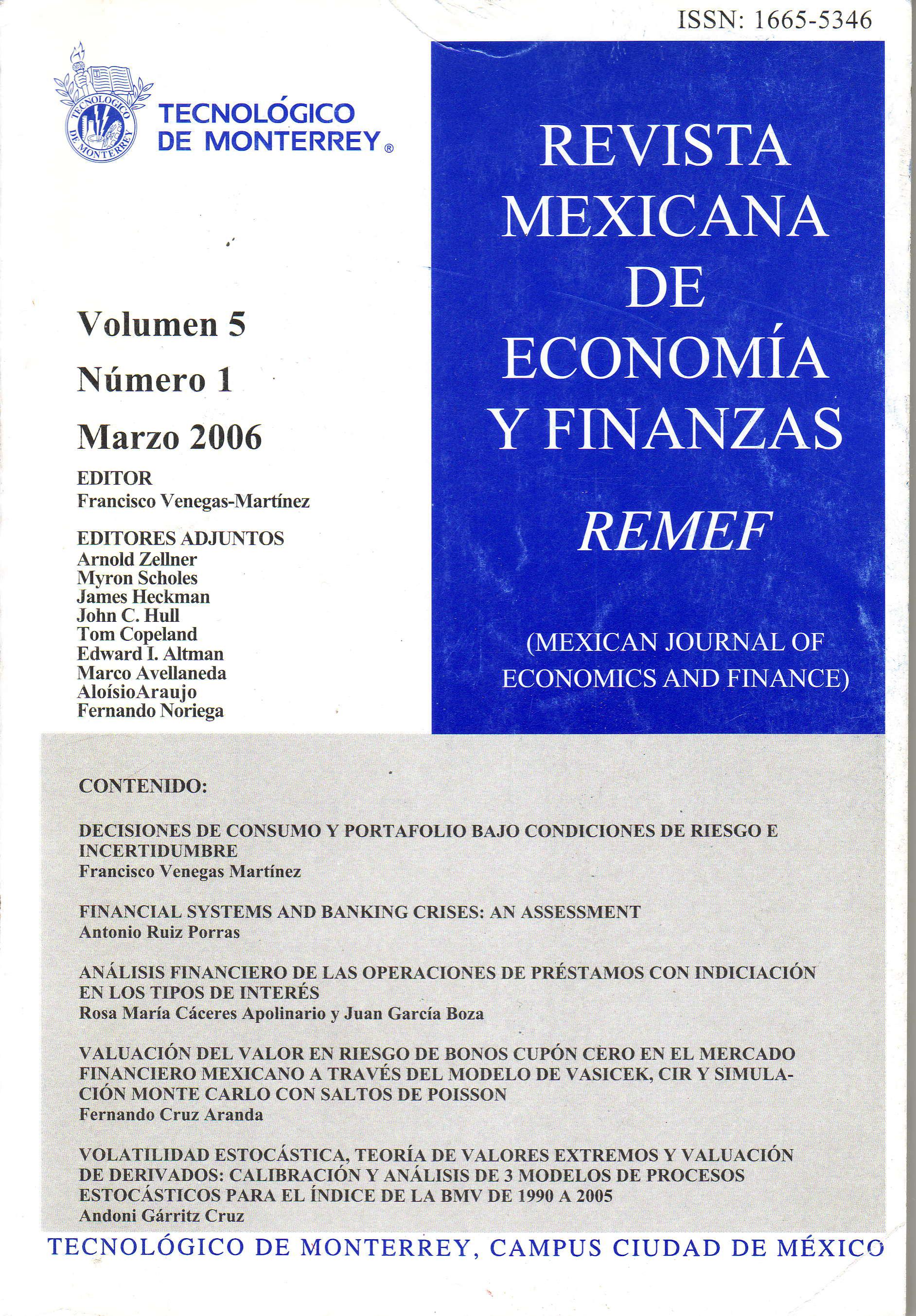

Ruiz-Porras, A. (2017). FINANCIAL SYSTEMS AND BANKING CRISES: AN ASSESSMENT. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 5(1). https://doi.org/10.21919/remef.v5i1.214

Issue

Section

Artículos