RELACIÓN ENTRE VALOR DE LA EMPRESA, DIVERSIFICACIÓN Y GOBIERNO CORPORATIVO

DOI:

https://doi.org/10.21919/remef.v4i3.205Abstract

This paper studies the relation between performance, diversification and ownership concentration for Chilean companies. We use balanced panel data for 52 public companies in 1995-2002 time period. We do not find conclusive results for the relation between performance and diversification. When the major owner has more than 40 percent of the company stocks we find a positive relation between this and the number of line of business in which the firm is involved. This last result is consistent with the alignment incentive hypothesis. Analyzing internal cash flows, we find weak evidence for the wealth redistribution hypothesis between major stockholders and minorities. When the major stockholder belongs to the family we observe a positive relation between performance and ownership if the major stockholder has more than 40 percent of the sha¡es. Once the major owner has more than 65 percent of the stocks this relation is negative. In the case of executives we find a positive relation between ownership and performance if they have more than 65 percent of the stocks. Finally, we do not report any significant relation when the major stockholder is a multinational company.Downloads

How to Cite

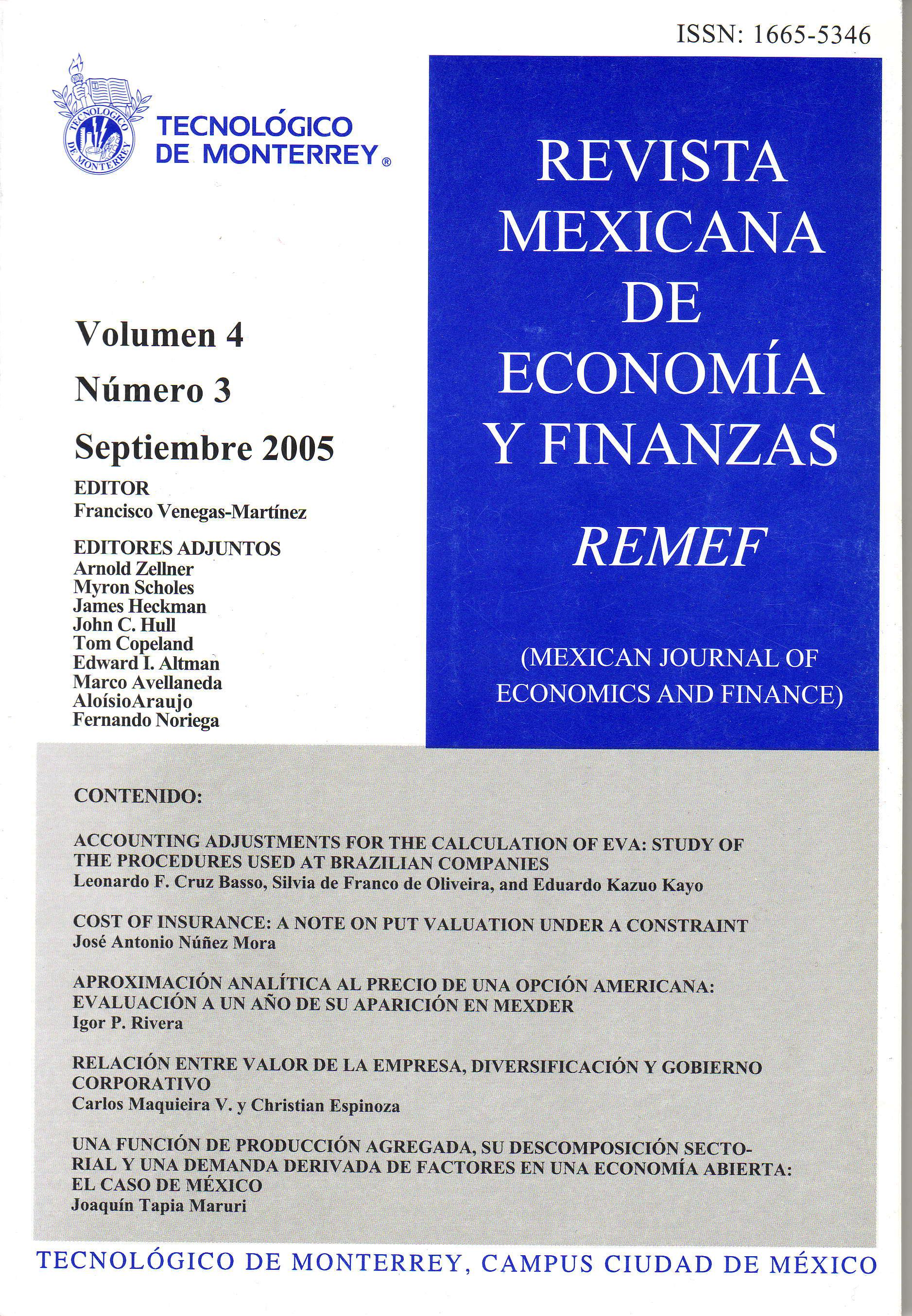

Maquieria V, C., & Espinoza, C. (2017). RELACIÓN ENTRE VALOR DE LA EMPRESA, DIVERSIFICACIÓN Y GOBIERNO CORPORATIVO. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 4(3). https://doi.org/10.21919/remef.v4i3.205

Issue

Section

Artículos