ACCOUNTING ADJUSTMENTS FOR THE CALCULATION OF EVA: STUDY OF THE PROCEDURES USED AT BRAZILIAN COMPANIES

DOI:

https://doi.org/10.21919/remef.v4i3.202Abstract

The shareholder value creation is becoming an answer to the pressure of the investors and councils. Many approaches are available. Among them, the Economic Value Added (EVA), developed by Stern Stewart & Co. To correct the improprieties perceived in financial statements, sorne users of EVA adjust the income numbers based on the Generally Accepted Accounting Principies (GAAP), expecting that such adjustments may produce more trustworthy values and generate an environment favorable to a management behavior closer to the optimum. Besides that, this work investigates the correlation between the brazilian controller understanding and the use of the company adopted accounting methods.Downloads

How to Cite

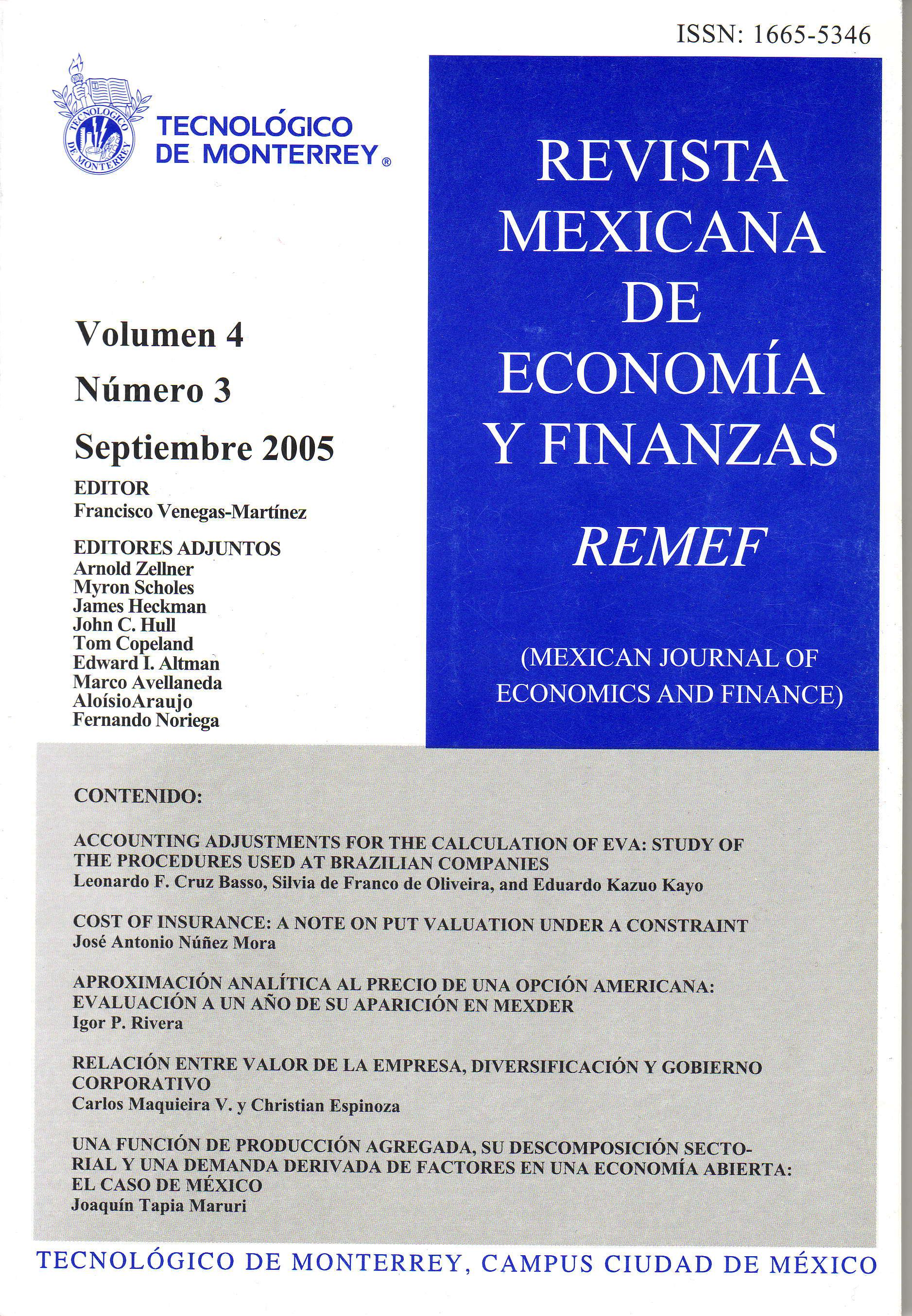

Cruz Basso, L. F., de Franco de Oliveira, S., & Kazuo Kayo, E. (2017). ACCOUNTING ADJUSTMENTS FOR THE CALCULATION OF EVA: STUDY OF THE PROCEDURES USED AT BRAZILIAN COMPANIES. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 4(3). https://doi.org/10.21919/remef.v4i3.202

Issue

Section

Artículos