MORAL HAZARD IN DEPOSIT INSURANCE: THE CASE OF FOBAPROA

DOI:

https://doi.org/10.21919/remef.v4i2.196Abstract

This paper is two-fold. First, it presents the institutional setting (deposit insurance schemes) of the Mexican commercial Banking system. Second, lt shows, using a pro bit model, that there was a moral hazard problem under FOBAPROA. One of the findings is that FOBAPROA encourages banks to hold less capital relative to assets under a private regime than under government control. I also find that FOBAPROA influences the loan-to-assets ratio. I do not find evidence, however, that FOBAPROA encourage banks to hold lower surplus-to-loans or reserve-to-deposits. Because of moral hazard associated with deposit insurance, troubled banks that had a small surplus-to-loans ratio have an incentive to take speculative positions.Downloads

How to Cite

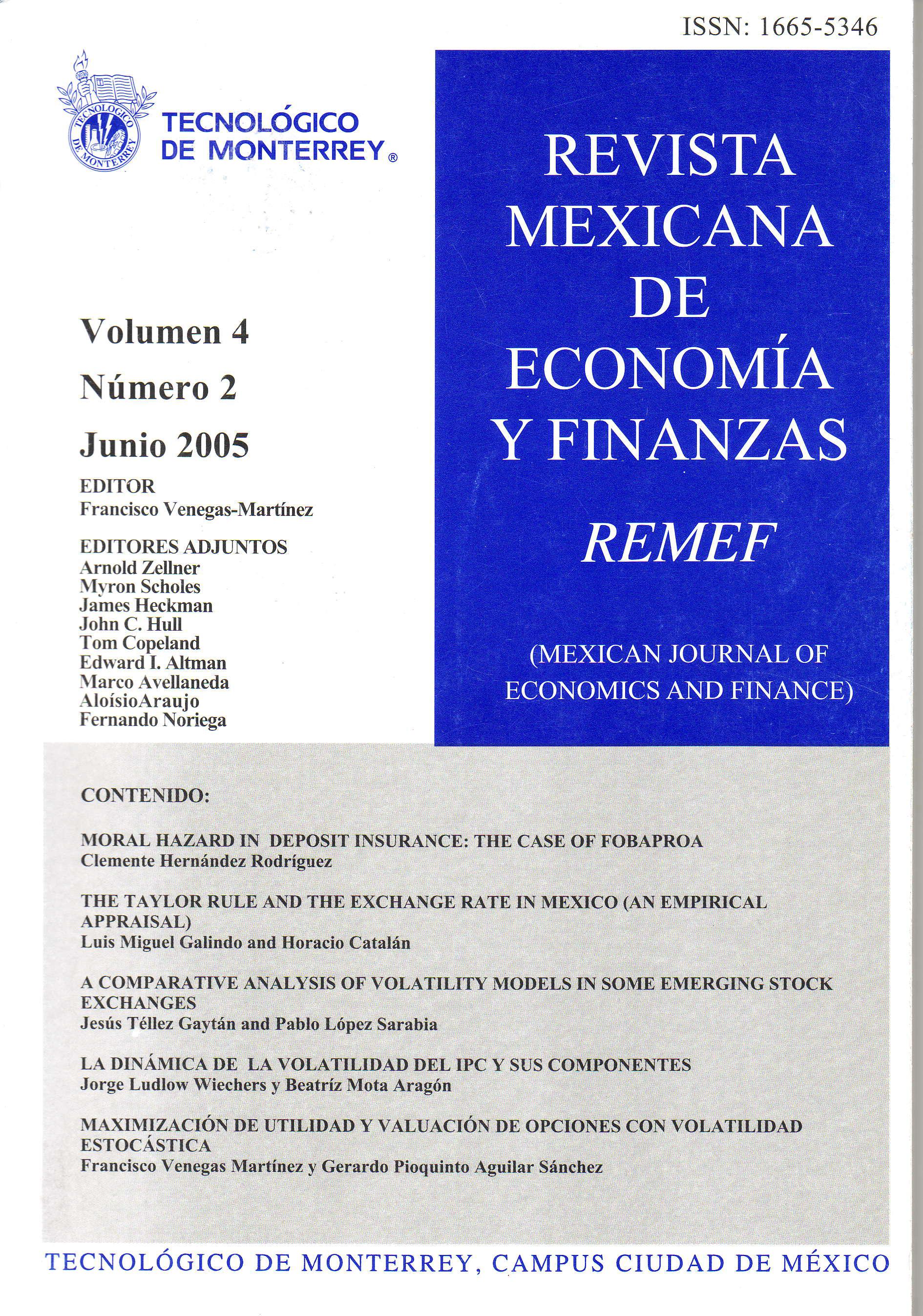

Hernández Rodríguez, C. (2017). MORAL HAZARD IN DEPOSIT INSURANCE: THE CASE OF FOBAPROA. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 4(2). https://doi.org/10.21919/remef.v4i2.196

Issue

Section

Artículos