IS PORTFOLIO DIVERSIFICATION ACHIEVABLE WITHIN THE MEXICAN STOCK MARKET?

DOI:

https://doi.org/10.21919/remef.v4i1.194Abstract

Diversification is most of the times considered a characteristic of any stock market. Nevertheless, recent research questions this issue specifically regarding to emerging markets given the synchrony of the returns of its instruments and Mexico is placed in the eye of the storm within the top ten. This analysis finds, with the use of a specific model, that investors can reduce around 50% of the standard deviation of the returns of a portfolio increasing the number of stocks it contains. So this concern should not be a reason for investors to avoid investing in the BMV.Downloads

How to Cite

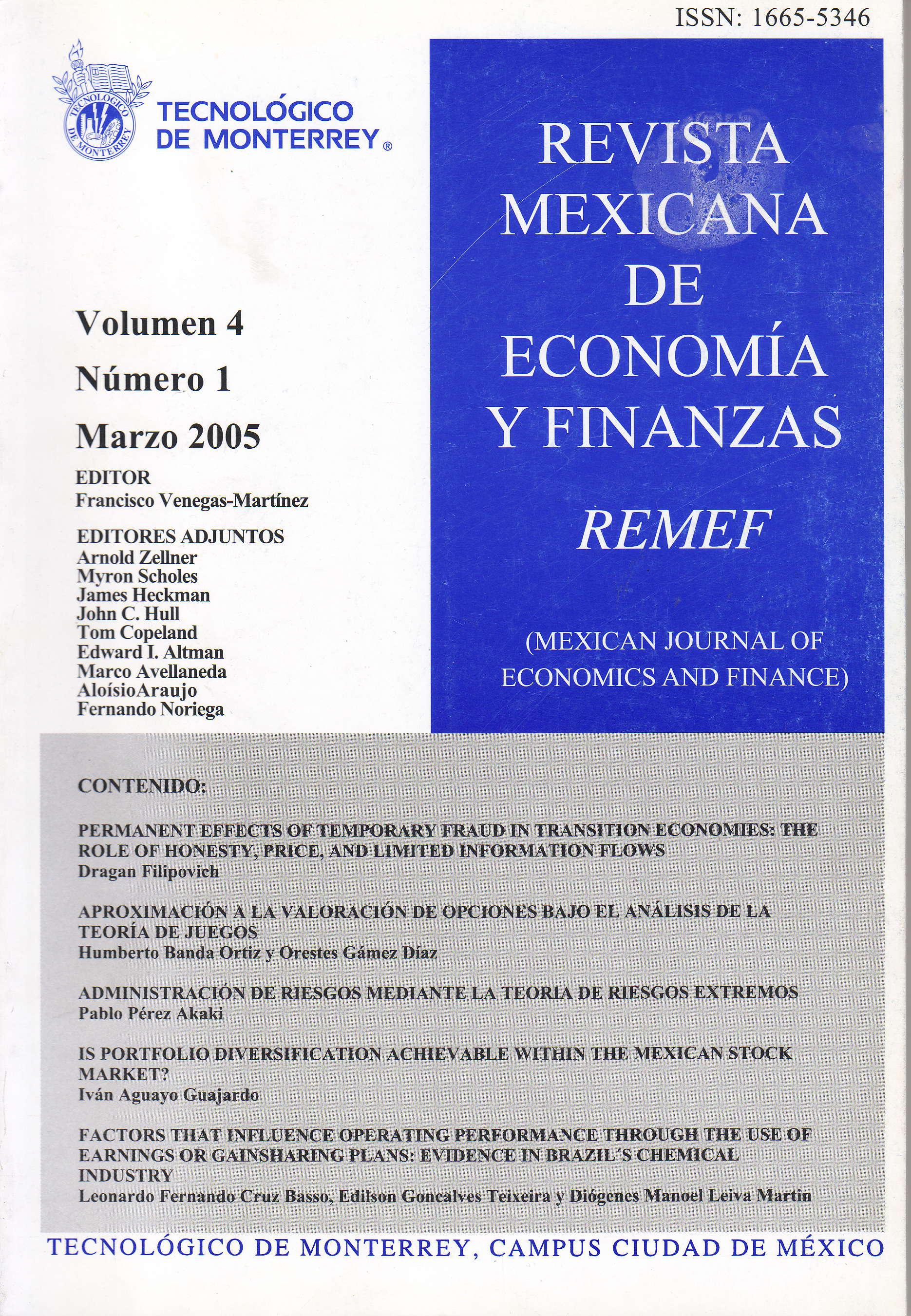

Aguayo Guajardo, I. (2017). IS PORTFOLIO DIVERSIFICATION ACHIEVABLE WITHIN THE MEXICAN STOCK MARKET?. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 4(1). https://doi.org/10.21919/remef.v4i1.194

Issue

Section

Artículos