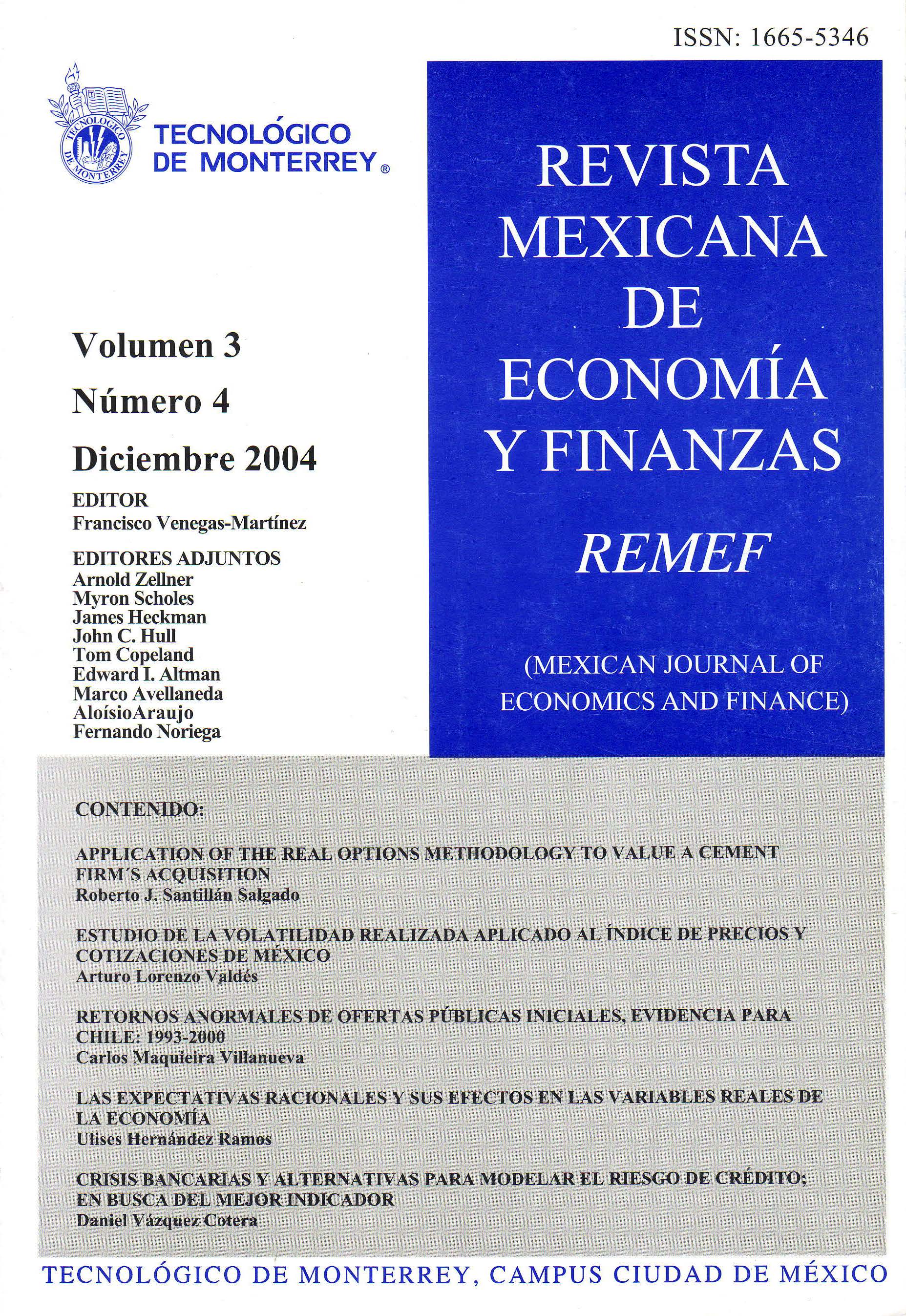

RETORNOS ANORMALES DE OFERTAS PÚBLICAS INICIALES, EVIDENCIA PARA CHILE: 1993 - 2000

DOI:

https://doi.org/10.21919/remef.v3i4.189Keywords:

Oferta pública inicial (IPO), Rentabilidades anormales acumuladas (CAR), Retorno del periodo de tenencia o retorno por tenencia en el largo plazo (HPR), Rentabilidad por comprar y mantener acciones por un periodo determinadoAbstract

The objective of this study is to analyze the behavior of the IPO's in Chile during the 90's, given the great percentage of Chilean companies that issue their stocks and lost an important amount of their value at that time. Therefore, we will compute the abnormal returns of IPO's far 1993-2000 period. We consider three methods that have been used to examine and prove the behavior that the IPO's had on the period under study: Cumulative Adjusted Returns (CAR) , Holding Period Returns or Buy and Hold Return (HPR), and the Three Factors Model of Fama and French. We find that 67 percent of the companies lost values far the study period but the results depend on the method used to compute the abnormal behavior of the returns.Downloads

How to Cite

Maquieira Villanueva, C. (2017). RETORNOS ANORMALES DE OFERTAS PÚBLICAS INICIALES, EVIDENCIA PARA CHILE: 1993 - 2000. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 3(4). https://doi.org/10.21919/remef.v3i4.189

Issue

Section

Artículos