APPLICATION OF THE REAL OPTIONS METHODOLOGY TO VALUE A CEMENT FIRM'S ACQUISITION

DOI:

https://doi.org/10.21919/remef.v3i4.172Keywords:

Computational techniques, Asset pricing, AcquisitionsAbstract

Discounted Cash Flow (DCF) analysis provides a conventional valuation platform for acquisition targets. Real Options Analysis (ROA) improves the quality of an acquisition's valuation through an objective determination of the worth of future possible managerial decisions (flexibility) that would be called for under different environmental scenarios. ROA is exemplified with a traditional DCF valuation of a target company in the cement industry to which the value of the ROA determined most important synergies is added. Finally both results are contrasted. The exercise concludes that by using ROA, acquiring firms may have a better informed negotiation position vis à vis the selling party.Downloads

How to Cite

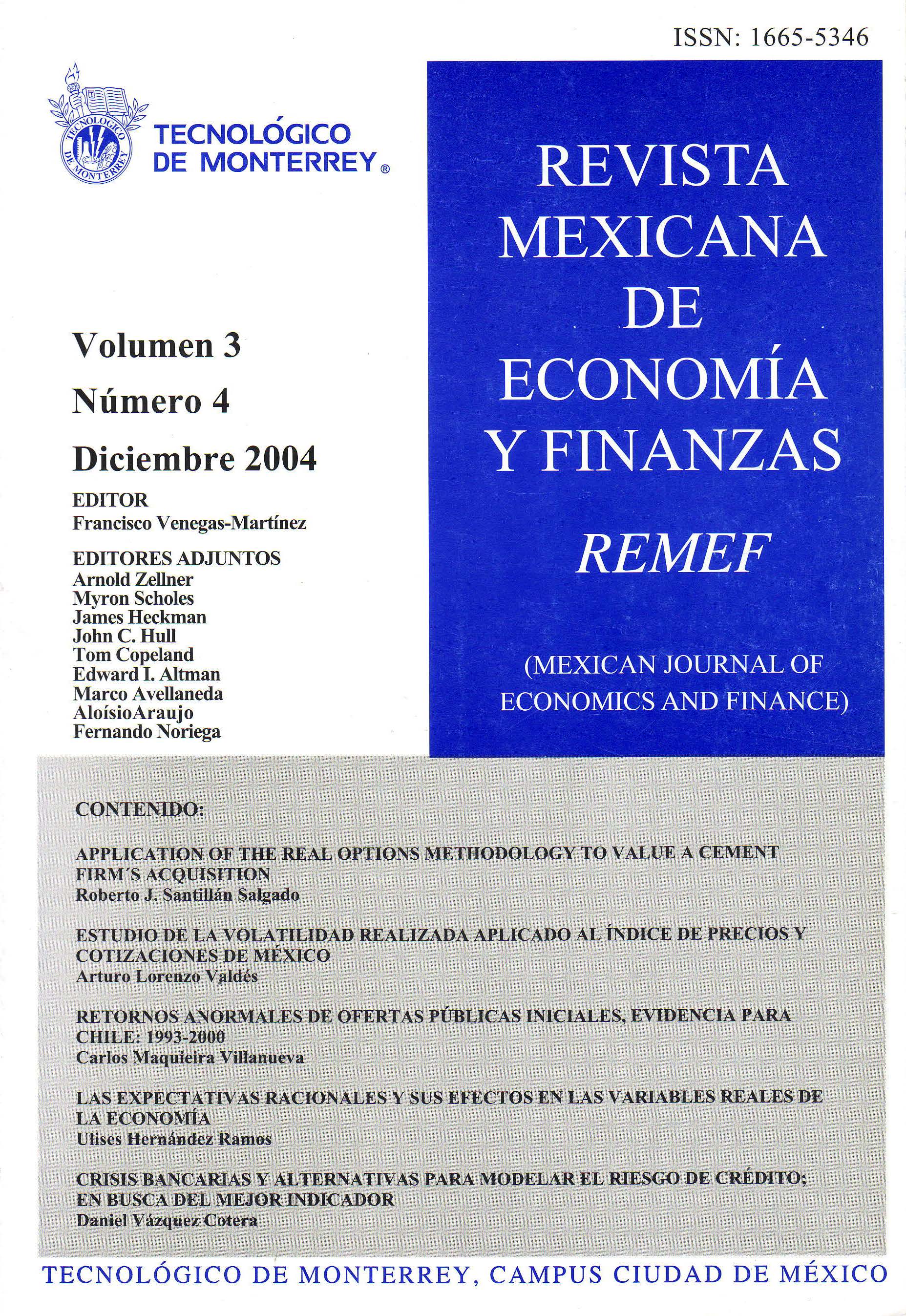

Santillán Salgado, R. J. (2017). APPLICATION OF THE REAL OPTIONS METHODOLOGY TO VALUE A CEMENT FIRM’S ACQUISITION. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 3(4). https://doi.org/10.21919/remef.v3i4.172

Issue

Section

Artículos