THE TERM STRUCTURE OF INTEREST RATES IN MEXICO: THE CETES MARKET

DOI:

https://doi.org/10.21919/remef.v2i4.158Keywords:

Term structure of interest rates, Expectation hypothesis, CETES marketAbstract

The objective of this paper is to analyze the Expectation Hypothesis (EH) of the term structure of interest rates in the public bond market in Mexico. The main results indicate that one and three months nominal interest rates are I(1) series and the spread is I(O). Furthermore, the Johansen (1988) procedure indicates that both series are cointegrated and therefore both series move together over time.Downloads

How to Cite

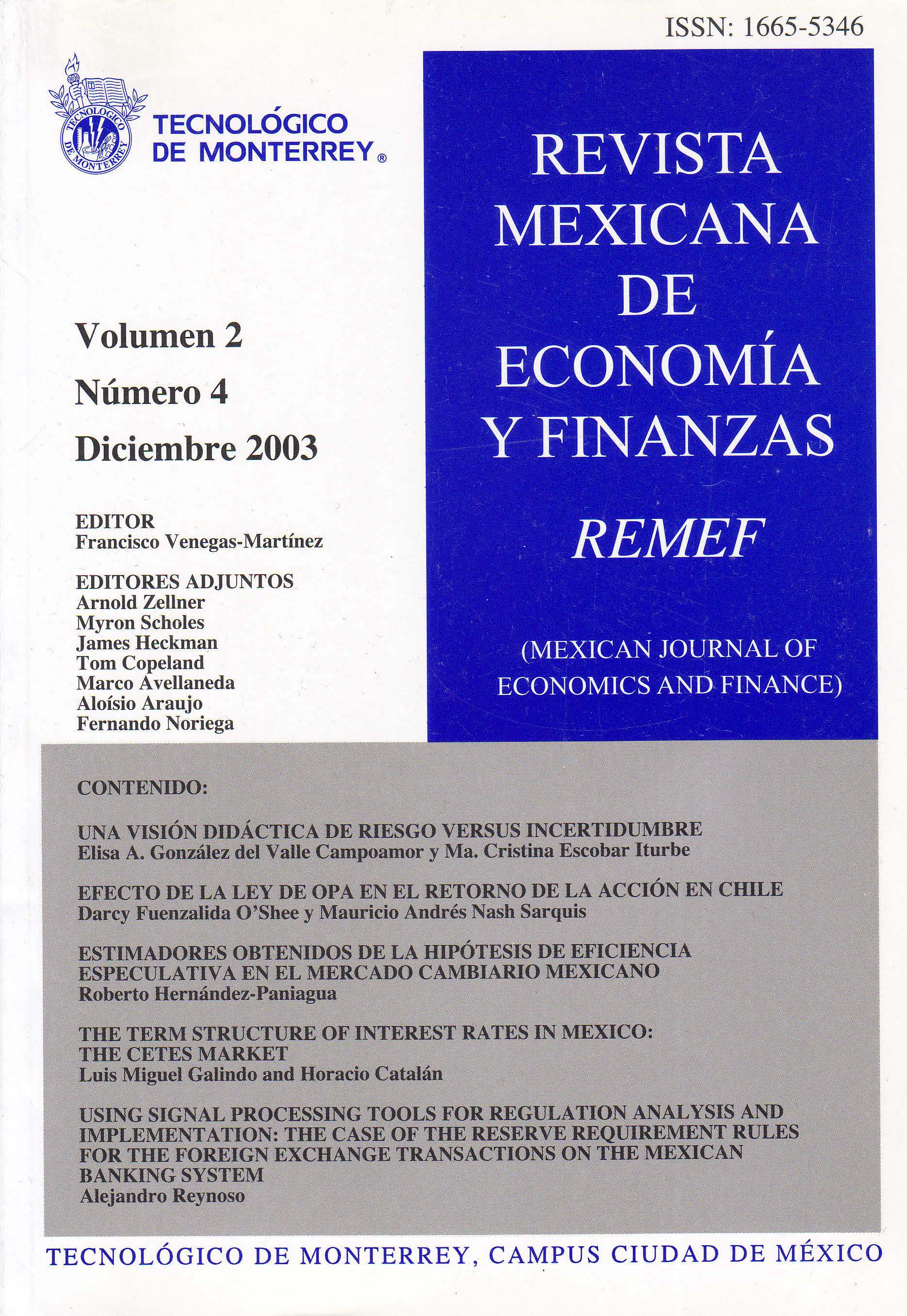

Galindo, L. M., & Catalán, H. (2017). THE TERM STRUCTURE OF INTEREST RATES IN MEXICO: THE CETES MARKET. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 2(4). https://doi.org/10.21919/remef.v2i4.158

Issue

Section

Artículos