ESTIMADORES OBTENIDOS DE LA HIPÓTESIS DE EFICIENCIA ESPECULATIVA EN EL MERCADO CAMBIARIO

DOI:

https://doi.org/10.21919/remef.v2i4.157Palabras clave:

Paridad de tasas de interés, Arbitraje internacionalResumen

Basado en el análisis clásico de los modelos de regresión lineal por el método de mínimos cuadrados ordinarios (OLS), se prueba la eficiencia de los estimadores muestrales obtenidos de la ecuación de la hipótesis de eficiencia especulativa (SEH), relacionada con Ja teoría de Ja Paridad de las Tasas de Interés (IRP) para el periodo de transición democrática del año 2000 en México. Asimismo, se evalúan los sistemas de determinación de los tipos de cambio forward en los mercados cambiarios.Descargas

Cómo citar

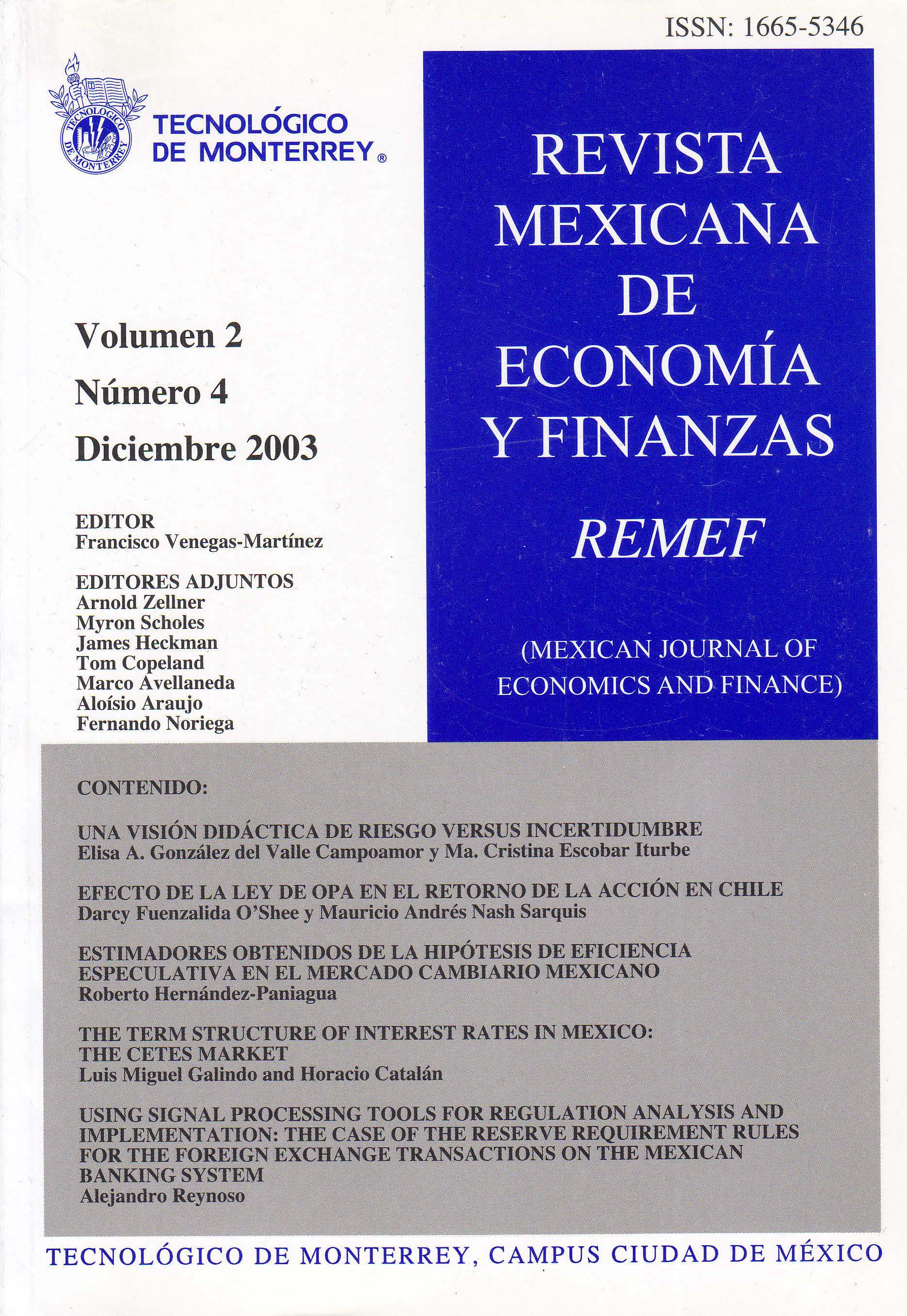

Hernández-Paniagua, R. (2017). ESTIMADORES OBTENIDOS DE LA HIPÓTESIS DE EFICIENCIA ESPECULATIVA EN EL MERCADO CAMBIARIO. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 2(4). https://doi.org/10.21919/remef.v2i4.157

Número

Sección

Artículos