¿EXISTEN COMPONENTES PRONOSTICABLES EN LAS SERIES DE LOS RENDIMIENTOS DE LAS ACCIONES?

DOI:

https://doi.org/10.21919/remef.v1i1.119Keywords:

Econometric and Statistical Methods, Financial MarketsAbstract

In this paper, the procedure developed by McQueen and Thorley (1991) to test for a random walk is applied, with some modifications, to the securities traded in the Mexican Stock Exchange. In order to, the daily returns of a portfolio made up of highly traded securities are examined by means of a second-order Markov chain avoiding the assumption of normality. The results of the estimation and the tests on the transition probabilities are presented and discussed. Also, it is investigated if the Markov chain is ergodic and therefore (covariance) stationary. Finally, forecasts based on the obtained estimations are provided.Downloads

How to Cite

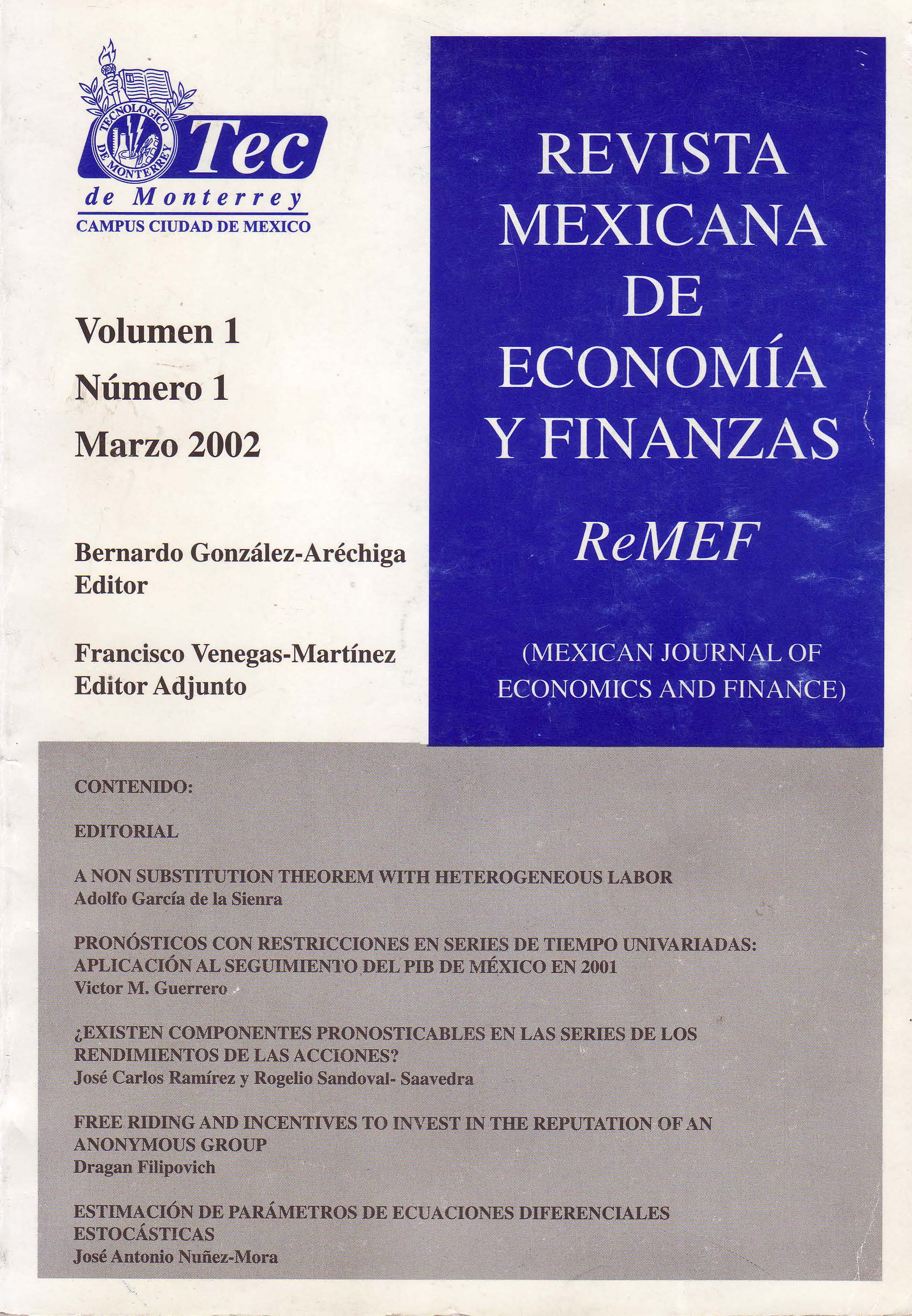

Ramírez, J. C., & Sandoval-Saavedra, R. (2017). ¿EXISTEN COMPONENTES PRONOSTICABLES EN LAS SERIES DE LOS RENDIMIENTOS DE LAS ACCIONES?. Revista Mexicana De Economía Y Finanzas Nueva Época REMEF (The Mexican Journal of Economics and Finance), 1(1). https://doi.org/10.21919/remef.v1i1.119

Issue

Section

Artículos