Financial stability, return, and asset, liability, and income diversification in Mexican largest bank

DOI:

https://doi.org/10.21919/remef.v18.2.777Palabras clave:

diversificación de activos, diversificación de pasivos, diversificación de ingresos, diversificación bancaria, bancos en MéxicoResumen

The current article is an analysis of the Mexican largest banks, aiming to establish if asset, liability, and / or income diversification affects, positively or negatively, and simultaneously both financial stability and return. We used 2010-2021 information and performed several linear and polynomial regression analyzes. Previous research papers considered two predictor, in the best cases. On this sense, the scope of our analysis is broader because we analyzed the Mexican banking systems with three potential predictors. Our research´s results indicate that for profitability purposes, asset and / or income concentration or specialization are optimal strategies. However, to reduce risk, banks should diversify their assets and / or income base. In terms of liabilities, banks might try to find the inflection point where maximizing return and minimizing risk are simultaneously achieved. Our conclusion is that diversification in general does not positively and simultaneously impact both risk and return. In other words: selective asset and income concentration positively impact return and that selective asset and income diversification reduce risk. Liabilities are more difficult to manipulate to achieve the mentioned objectives.

Descargas

Métricas

Citas

Abuzayed, B., Al-Fayoumi, N., & Molyneux, P. (2018). Diversification and bank stability in the GCC. Journal of International Financial Markets, Institutions & Money, 57, 17-43. https://doi.org/10.1016/j.intfin.2018.04.005

Allen, L., & Jagtiani, J. (2000). The Risk Effects of Combining Banking, Securities, and Insurance Activities. Journal of Economics and Business, 52(6), 485-497. https://doi.org/10.1016/s0148-6195(00)00033-3

Alves, J., Ribeiro, O., & Paulo, E. (2011). Relação entre concentração e rentabilidade no setor bancário brasileiro. Revista Contabilidade & Finanças, 22(55), 5-28. https://doi.org/10.1590/s1519-70772011000100002

Archaya, V., Hasan, I., & Saunders, A. (2002). The Effects of Focus and Diversification on Bank Risk and Return: Evidence from Individual Bank Loan Portfolios. CEPR Discussion Paper No. 3252, 1 - 49. Sourced from Available at SSRN: https://ssrn.com/abstract=306768 https://doi.org/10.2139/ssrn.293295

Bátiz‐Lazo, B., & Wood, D. (2003). Strategy, competition, and diversification in European and Mexican banking. International Journal of Bank Marketing, 21(4), 202-216. https://doi.org/10.1108/02652320310479196

Berger, A. N., & Bouwman, C. H. (2013). How does capital affect bank performance during financial crises? Journal of financial economics, 109(1), 146-176. https://doi.org/10.1016/j.jfineco.2013.02.008

Campa, J., & Kedia, S. (2002). Explaining the diversification discount. The Journal of Finance, 57, 1731-1761. https://doi.org/10.1111/1540-6261.00476

Carrera, Y. (2019). La diversificación de ingresos y el riesgo de insolvencia en el sector bancario del Ecuador. Ecuador: Universidad Técnica de Ambato (Tesis). https://doi.org/10.48082/espacios-a21v42n04p03

Chavarín Rodríguez, R. (2015). Determinants of commercial bank profitability in Mexico. EconoQuantum, 12(1), 97-123. https://doi.org/10.18381/eq.v12i1.4855

Chiorazzo, V., Milani, C., & Salvini, F. (2008). Income diversification and bank performance: Evidence from Italian banks. Journal of financial services research, 33(3), 181-203. https://doi.org/10.1007/s10693-008-0029-4

Córdoba, F., & Neira, Y. (2017). Competencia y diversificación en el sector bancario: ¿Puede el entorno institucional condicionar sus efectos sobre la estabilidad financiera? Los Ángeles: Universidad de Concepción (Tesis).

Cortez, G. C. (2014). Diversificación de la Cartera de Activos de la Banca Múltiple en el Perú: 2001-2011. Pensamiento crítico, 18(1), 43-55. https://doi.org/10.15381/pc.v18i1.8748

Denis, D., Denis, D., & Sarin, A. (1997). Agency Problems, Equity Ownership and Corporate Diversification. Journal of Finance, 52(1), 135–160. https://doi.org/10.1111/j.1540-6261.1997.tb03811.x

Elsas, R., Hackethal, A., & Holzhäuser, M. (2006). The anatomy of bank diversification. Ludwig-Maximilians Universität München, Discussion Paper, No. 2006-01, 1-30.https://doi.org/10.2139/ssrn.968214

Escobar, N. A. (2019). Estructura del mercado y diversificación bancaria ¿Puede el entorno institucional condicionar su efecto en el desempeño bancario? Concepción, Chile: Universidad de Concepción (tesis). https://doi.org/10.32457/12728/9842201992

Ghosn, F. (2019). Testing Z-Score Model on Lebanese Listed Banks. Research Journal of Finance and Accounting, 10(12), 78 - 85. https://doi.org/10.7176/rjfa/10-12-10

Gujarati, D. (1992). Econometría (2 ed.). McGraw Hill, México.

Hannan, T. H., & Hanweck, G. A. (1988). Bank Insolvency Risk and the Market for Large Certificates of Deposit. Journal of Money, Credit and Banking, 20(2), 203–211. https://doi.org/10.2307/1992111

Hsieh, M. F., Chen, P. F., Lee, C. C., & Yang, S. J. (2013). How does diversification impact bank stability? The role of globalization, regulations, and governance environments. Asia‐Pacific Journal of Financial Studies, 42(5), 813-844. https://doi.org/10.1111/ajfs.12032

Jara, M., Arias, J. T., & Rodríguez, A. (2011). Diversificación y determinantes del desempeño bancario: una comparación internacional. Estudios de Administración, 18(2), 1-48.

Kim, H., Batten, J. A., & Ryu, D. (2020). Financial crisis, bank diversification, and financial stability: OECD countries. International Review of Economics & Finance, 65, 94-104. https://doi.org/10.1016/j.iref.2019.08.009

Kwoka, J. E. (1985). The Herfindahl index in theory and practice. The Antitrust Bulletin, 30(4), 915 -947. https://doi.org/10.1177/0003603x8503000405

Laeven, L., & Levine, R. (2007). Is there a diversification discount in financial conglomerates? Journal of financial economics, 85(2), 331-367. https://doi.org/10.1016/j.jfineco.2005.06.001

Lastre-Valdés, M. M. (2015). (). Predicción de insolvencia, confiabilidad y calidad de los sistemas organizaciones. Ciencias Holguín, 21(4), 1-14.

Lepetit, L., Nys, E., Rous, P., & Tarazi, A. (2006). Product diversification in the European banking industry: Risk and loan pricing implications. 87031, págs. 1 - 34. Limoges Cedex, France: Université de Limoges. Sourced from https://papers.ssrn.com/sol3/papers.cfm?abstract_id=873490 https://doi.org/10.2139/ssrn.873490

Lepetit, L., Nys, E., Rous, P., & Tarazi, A. (2008). Bank income structure and risk: An empirical analysis of European banks. Journal of Banking and Finance, 32(8), 1452 - 1467. https://doi.org/10.1016/j.jbankfin.2007.12.002

Levy Orlik, N., & Domínguez Blancas, C. (2014). The foreign banks in Mexico: diversification of activities and his effect in the structure of income. Economía UNAM, 11(32), 102-119.

Lozano - Vivas, A. (1992). Un estudio de la eficiencia y economías de diversificación del sistema bancario español. Revista Española de Financiación y Contabilidad, 21(73), 855-880. https://doi.org/10.1080/02102412.2013.11102928

Marinho, C. A., & de Araújo, L. F. (2016). Diversificação das receitas e risco de insolvência dos bancos brasileiros. Revista De Contabilidade E Organizações, 10(28), 3-17. https://doi.org/10.11606/rco.v10i28.111758

Martínez, A., Zuleta, L., Misas, M., & Jaramillo, L. (2016). La competencia y la eficiencia en la banca colombiana. Bogotá: Fedesarrollo y Asobancaria.

Mercieca, S., Schaeck, K., & Wolfe, S. (2007). Small European banks: Benefits from diversification? Journal of Banking & Finance, 31(7), 1975-1998. https://doi.org/10.1016/j.jbankfin.2007.01.004

Muñoz, J. A., Sepúlveda, S. M., Veloso, C. L., & Delgado, C. (2020). ¿ Son persistentes los efectos de la concentración de mercado y la diversificación de ingresos sobre el desempeño bancario? Ecos de Economía , 24(50), 25-44. https://doi.org/10.17230//ecos.2020.50.2

Palomino, M. (2015). Estructura de ingresos y riesgo bancario en España. Málaga: Universidad de Málaga (Tesis).

Paltrinieri, A., Dreassi, A., Rossi, S., & Khan, A. (2021). Risk-adjusted profitability and stability of Islamic and conventional banks: Does revenue diversification matter? Global Finance Journal, 50, 100517. https://doi.org/10.1016/j.gfj.2020.100517

Patrón, L. (2015). Efectos de la diversificación de cartera sobre la rentabilidad de la banca comercial en Bolivia empleando el monitoreo como factor educativo: un modelo de teoría de juegos. La Paz, Bolivia: Universidad Andina Simón Bolívar (Tesis). https://doi.org/10.4000/books.irdeditions.19547

Sanya, S., & Wolfe, S. (2011). Can banks in emerging economies benefit from revenue diversification? Journal of Financial Services Research, 40(1), 79-101. https://doi.org/10.1007/s10693-010-0098-z

Serpa, B. (2020). Los efectos de la diversificación de la cartera de préstamos en el rendimiento y riesgo del sistema bancario peruano. Lima: Universidad Peruana de CIencias Aplicadas (Tesis). https://doi.org/10.19083/tesis/648693

Shim, J. (2019). Loan portfolio diversification, market structure and bank stability. Journal of Banking & Finance, 104, 103-115. https://doi.org/10.1016/j.jbankfin.2019.04.006

Smith, R., Staikouras, C., & Wood, G. (2003). Smith, R., Staikouras, C. y Wood, G. (2003). Non-interest. Sourced from Bank of England: https://www.bankofengland.co.uk/-/media/boe/files/working-paper/2003/non-interest-income-and-total-income-stability.pdf

https://doi.org/10.2139/ssrn.530687

Stiroh, K. (2004). Diversification and Banking: Is Noninterest Income the Answer? Journal of Money, Credit and Banking, 36(5), 853-882. https://doi.org/10.1353/mcb.2004.0076

Stiroh, K. (2006). A Portfolio View of Banking with Interest and Noninterest Activities. Journal of Money, Credit, and Banking, 38(5), 1351-1361. https://doi.org/10.1353/mcb.2006.0075

Trujillo‐Ponce, A. (2013). What determines the profitability of banks? Evidence from Spain. Accounting & Finance, 53(2), 561-586. https://doi.org/10.1111/j.1467-629x.2011.00466.x

Verlekar, R. (2019). An Application and Comparison of Bankruptcy Models in the Indian Banking Sector. International Journal of Financial Management, 9(4), 42 - 53.

Xu, J. (1996). An Empirical Estimation of the Portfolio Diversification Hypothesis: The Case of Canadian. The Canadian Journal of Economics, 29(1), 192-197. https://doi.org/10.2307/135985

Descargas

Publicado

Cómo citar

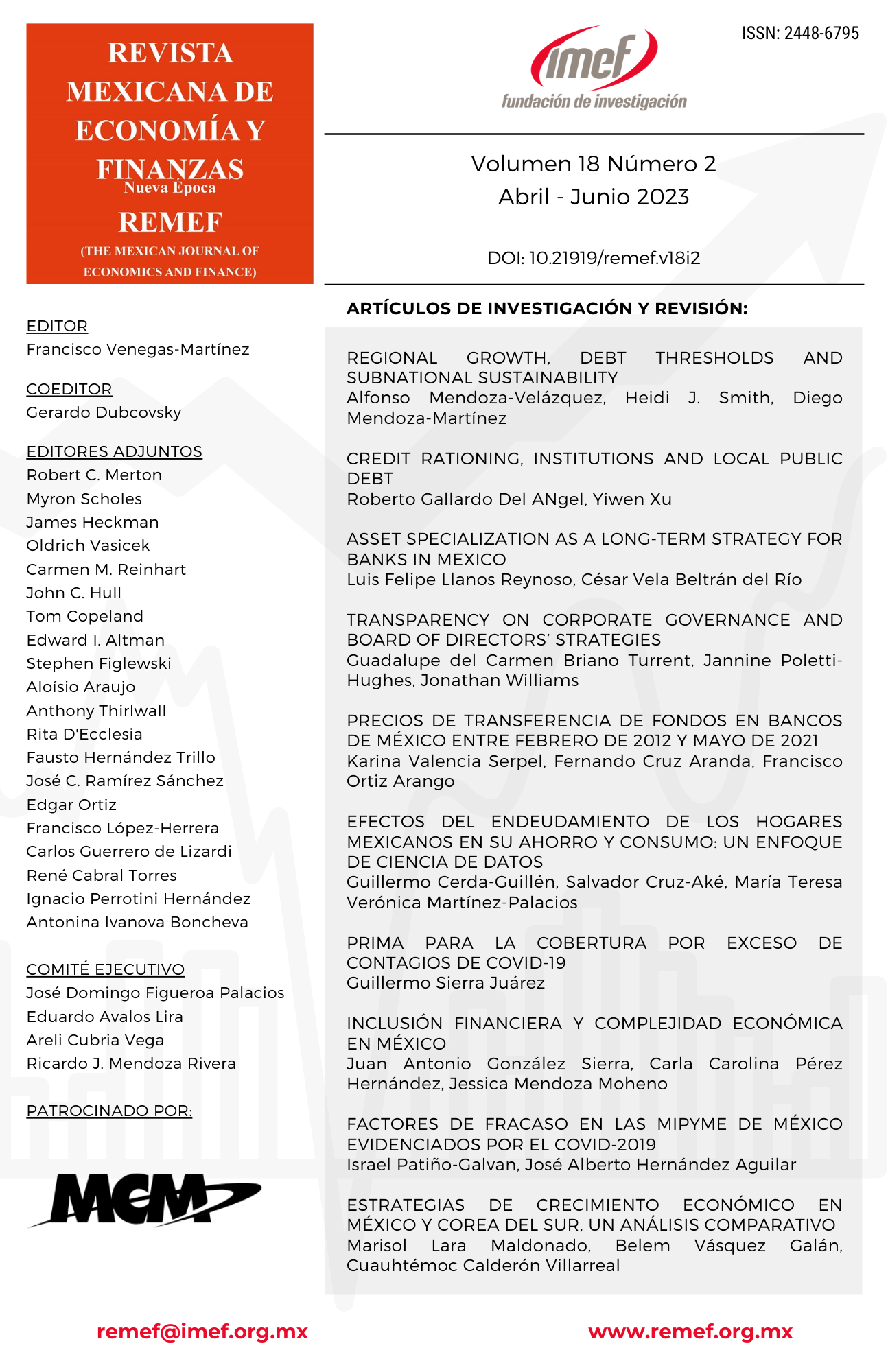

Número

Sección

Licencia

Derechos de autor 2023 Revista Mexicana de Economía y Finanzas Nueva Época REMEF

Esta obra está bajo una licencia internacional Creative Commons Atribución-NoComercial 4.0.

PlumX detalle de metricas